estate tax exclusion amount sunset

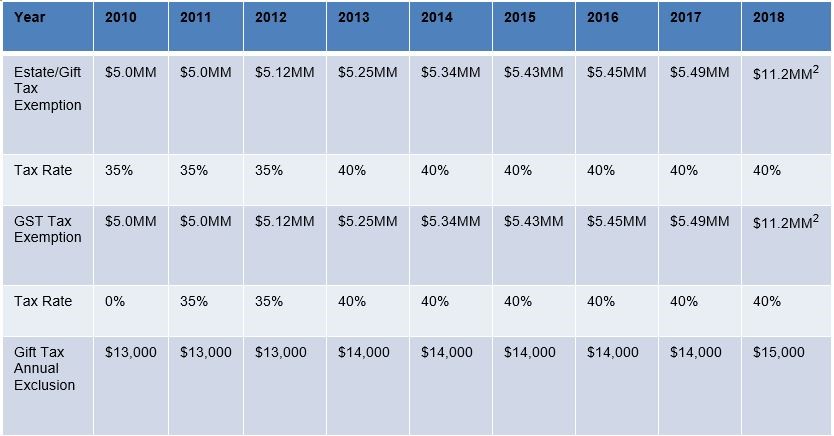

If you give your brother 1016 million you will have to report a taxable gift of 1 million. Under the 2010 Tax Relief Act the lifetime estate and gift tax basic exclusion amount was 5000000 and this amount was indexed for inflation after 2011 and increased over time as shown below.

What Is The New Residential Property Tax Being Considered In Hawaii Mansion Global

The estate tax.

. 2001g2 addressing circumstances that can occur only after Dec. Yes you read that correctly absent legislative reform the federal applicable exclusion amount will increase by 360000 720000 for a married. We arent sure what you will be living on between 2025 and the date of your death but at least no death tax will be payable.

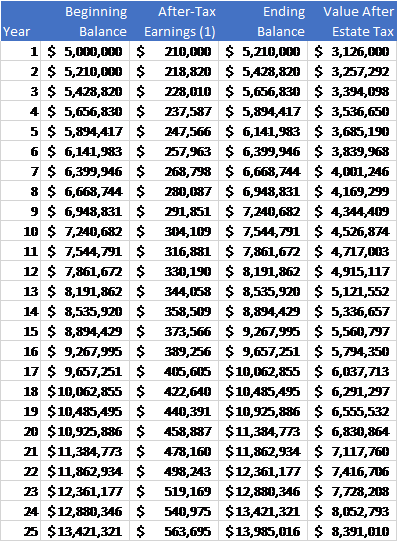

The estate tax due would be zero. The federal estate tax exemption for 2022 is 1206 million. The amount of the estate tax exemption that was not used for the deceased spouses estate can be transferred to the surviving spouse if the first spouse dies and the value of their estate doesnt use up all the exemption.

The estate tax exemption is adjusted for inflation every year. In lieu of throwing money at a hole I prefer to THINK about how to best take advantage of the higher estate tax exemption amounts while they presently remain available at 1206 million in 2022. Estate Tax Annual adjustment of the applicable exclusion amount for estates of decedents dying in Calendar Year 202 2 Introduction The Department of Revenue must adjust the Washington applicable exclusion amount annually using the Seattle- Tacoma-Bremerton metropolitan area October.

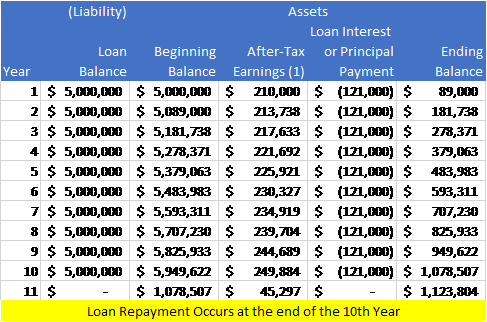

Importantly the current doubled base exemption value of 10000000 is slated to sunset meaning that it will revert to 5000000 effective January 1 2026 unless Congress acts to extend current law. For many boomers the sunset of the current estate and gift tax provisions provides the greatest gloom. Notably the TCJA provision that doubled the gift and estate tax exemption from 5 million to 10 million adjusted annually for inflation will revert to pre-2018 levels after 2025.

After that the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million. For more information about this and other TCJA provisions visit IRSgovtaxreform. The federal estate gift and generation-skipping transfer tax exemption amounts are currently set at 1158 million per individual or 2316 million for.

Because the exclusion amount is back to 115 million your estate tax is 46 million. 2 In addition the 40 maximum gift and estate tax rate is set to increase to 45 in 2026. The Tax Cuts and Jobs Act of 2017 increased the unified Gift and Estate Tax Exemption from 55 million to 11 million per person.

And to find the amount due the fair market values of all the decedents assets as of death are added up. As the IRS released on November 22 2019 The Treasury Department and the Internal Revenue Service today issued. 2001g addressing the effect of changes in tax rates and exclusion amounts in the computation of the estate tax and Sec.

Assume that the federal estate tax exemption is still 1158 million at the time of Sues later death. The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021. Adjusted for inflation the exemption now stands at 1206 million for 2022.

If you havent reviewed your. A window of opportunity opened in 2018 when the Tax Cuts and Jobs Act TCJA doubled the lifetime gift estate and generation-skipping tax. A dies in 2026.

The Sunset Provision of the Temporary Increase in Estate Tax Exemption. This resulted in a unified lifetime exemption of 11400000 in 2019 and 11580000 in 2020. The current 11700000 federal estate tax exemption amount would drop to 5 million adjusted for inflation as of January 1 2022.

Even if the BEA is lower that year As estate can still base its estate tax calculation on the higher 9 million of BEA that was used in 2018. This means that if you pass away before 2026 your estate tax threshold will be 11 million instead of 12 million. 1 Any funds after.

In 2025 you both give zero to your heirs and you both die in 2026 with an estate of 23 million. Under the 2017 Tax Act the basic exclusion is increased from 5000000 to 10000000 for 2018 and the 10000000 is indexed for inflation occurring after 2011. This increased exemption is scheduled to sunset on December 31 2025 and revert to 5 million per person as adjusted for inflation.

However the favorable estate tax changes in the TCJA are currently scheduled to sunset after 2025 unless Congress takes further action. The estate-tax exemption rose to 1158 million in 2020 180000 higher than the year before to account for inflation. TCJA doubled the estate and gift tax exemption to 112 million for single filers 224 million for couples and continued to index the exemption levels for inflation.

The current estate and gift tax exemption is scheduled to end on the last day of 2025. Page 1 of 2. The option of portability that existed before the TCJA continues meaning that through proper planning a married couple can maximize their use of the exemption.

The current estate and gift tax exemption law sunsets in 2025 and the exemption amount will drop back down to the prior laws 5 million cap which when adjusted for inflation is expected to be about 62 million. The amount is 1118 million for an individual in 2018 and 2236 million dollars for a married couple. Theres still a lot of cushion there which is why in practice very few people really have to worry about filing gift tax returns.

A uses 9 million of the available BEA to reduce the gift tax to zero. The current estate tax exemption is. 31 2025 when the BEA increase sunsets and drops to 5 million.

The estate tax is a tax on an individuals right to transfer property upon your death. Website builders As 2026 approaches families who have more than 10M or individuals with more than 5M may be served well from making more than 5M of completed gifts and utilizing the higher estate exclusions before they sunset. The preamble states this assertion is inconsistent with both Sec.

Harpta Firpta Tax Withholdings Avoid The Pitfalls

10 Best States For Lowest Taxes Moneygeek Com

Tax For Expats Claiming Dependents On Your Us Tax Return

Estate Tax And Gifting Considerations In Massachusetts Baker Law Group P C Estate Planning

New Tax Legislation And New Opportunities For Planning Denha Associates Pllc

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

9 Estate Planning Resolutions For The New Year Buckley Law P C

Burning Sunset Saguaro National Park Arizona Law Offices Of David L Silverman

Hawaii Property Taxes Surprising Facts You Should Know Move To Hawaii 365

Tax Tips For Military Personnel With Income From Rental Properties Article The United States Army

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

An Explanation Of Us Taxes For Pilots And Seafarers

Top Five Strategies For Avoiding Estate Taxes Estate Tax Garden Center Social Media Infographic

/landscape-with-winding-river-at-sunset-1068087040-7cbd1d12e9ca498294dd6423f46f53c1.jpg)